BTC Price Prediction: Navigating the Current Market Correction

#BTC

- Bitcoin is testing critical technical support at $104,456 with bearish MACD momentum

- Mixed market sentiment between Fed hawkishness and institutional accumulation creates uncertainty

- Long-term adoption trends remain positive despite short-term correction pressures

BTC Price Prediction

Technical Analysis: Bitcoin Faces Critical Support Test

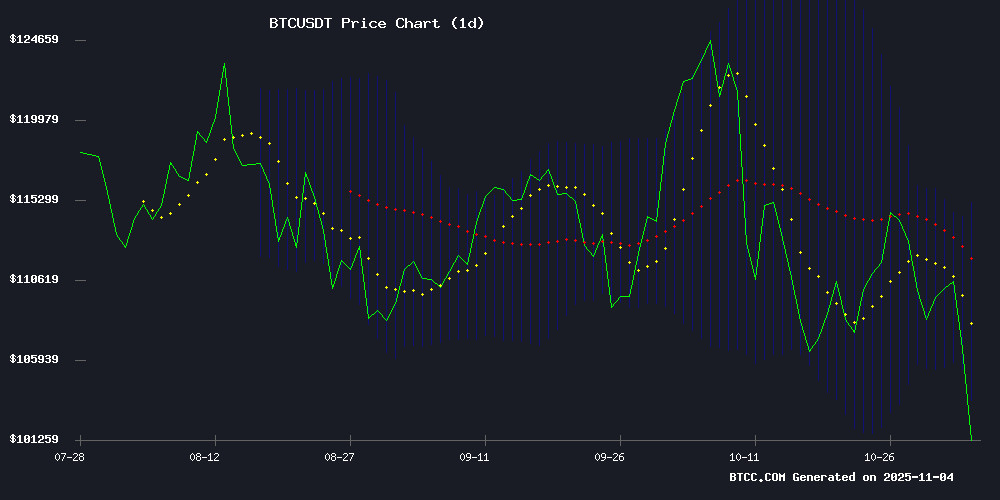

Bitcoin is currently trading at $104,219.97, below its 20-day moving average of $109,526.99, indicating short-term bearish momentum. The MACD shows a negative reading of -1,261.04, suggesting weakening bullish momentum. However, the price is testing the lower Bollinger Band at $104,456.99, which could provide immediate support. According to BTCC financial analyst Emma, 'The technical setup shows Bitcoin is at a crucial juncture. A break below the Bollinger Band support could trigger further declines toward $100,000, while holding above this level might lead to consolidation.'

Market Sentiment: Mixed Signals Amid Institutional Interest

Current market sentiment reflects a tug-of-war between bearish macroeconomic pressures and underlying institutional accumulation. News headlines highlight Federal Reserve hawkishness triggering sell-offs and long-term holders liquidating positions, creating near-term pressure. However, BTCC financial analyst Emma notes, 'Despite the negative headlines, we're seeing institutional accumulation during this correction phase. The Standard Chartered CEO's declaration that cash is obsolete and the record $42M+ in bitcoin casino tournaments demonstrate growing mainstream adoption that could support prices long-term.' The sentiment aligns with technical analysis suggesting potential consolidation before the next directional move.

Factors Influencing BTC's Price

Bitcoin Targets Liquidity Surge Amid Central Bank Interventions

Global liquidity conditions are shifting dramatically as central banks deploy unprecedented measures. The US M2 money supply hit $22.2 trillion in September, marking 19 consecutive months of growth. While the 4.5% annual increase remains below the 6.3% long-term average, inflation-adjusted growth of 1.4% continues a 13-month upward trend.

Market participants now watch Bitcoin's correlation with liquidity indicators intensify. The cryptocurrency's recent price movements mirror gold's response to monetary expansion—a pattern last seen during peak quantitative easing eras. This resurgence of the money-supply correlation establishes Bitcoin as a macro asset.

The Federal Reserve's $29.4 billion overnight repo operation—the largest single-day injection since the dot-com era—coincided with massive PBOC interventions. These synchronized liquidity measures create a crossroads for risk assets. Treasury sell-offs signal mounting pressure in short-term credit markets, prompting investors to monitor central bank balance sheets through 2026.

Bitcoin Tests $103K Support as Analysts Warn of Potential Drop to $92K

Bitcoin's price action has turned precarious following the October 11 liquidation event, with the $104,000 support level failing to hold. The cryptocurrency now hovers near $103,732 on Bitstamp, leaving traders to question whether this represents a final flush before reversal or the start of deeper declines.

Market structure appears damaged after BTC lost its multi-week support zone. Analysts point to the CME gap near $92,000 as a likely magnet should selling pressure persist. The NUPL indicator flashing -0.058 confirms retail traders are now underwater, compounding negative sentiment.

Altcoins mirror BTC's weakness amid macroeconomic uncertainty. 'The price is approaching the bottom of the zone where it formed its first higher low after the October rebound,' observes Daan Crypto Trades, suggesting this retest could determine the next major directional move.

Bitcoin Plunges Below $106K as Fed Hawkishness Sparks Crypto Sell-Off

The cryptocurrency market faced a brutal reckoning on November 3 as Bitcoin collapsed below $106,000, erasing $156 billion in global market capitalization within 24 hours. Over $1.29 billion in leveraged positions were liquidated amid a cascading sell-off that hit meme coins and altcoins hardest.

Federal Reserve Chair Jerome Powell's October 29 remarks set the stage for the downturn, dousing expectations of a December rate cut with hawkish rhetoric. The CME FedWatch Tool now prices just a 69.3% probability of easing, down from 78% previously. As Treasury yields rose and the dollar strengthened, institutional investors raced to lock in profits across risk assets.

Market structure exacerbated the pain. Bitcoin's breach of $110,000 support triggered algorithmic selling, accelerating the descent through $106,000. The bloodletting exposed overleveraged traders who had positioned for continued rallies, particularly in speculative meme tokens.

Bitcoin Casino Tournaments Offer Record $42M+ Crypto Prizes as Gambling Meets DeFi

The intersection of decentralized finance and competitive gaming has birthed a new paradigm in high-stakes wagering. Bitcoin casino tournaments now attract a demographic that views crypto gambling as an extension of speculative investing—young, affluent participants treat entry fees as volatile asset positions rather than mere entertainment costs.

Prize pools have reached staggering levels, dwarfing traditional online poker benchmarks. While poker tournaments have awarded seven-figure BTC payouts, modern slot and crash games now deliver jackpots approaching $42 million—creating what industry observers call "the crypto-gambling gold rush."

Success in this arena demands trader-like discipline. Participants must approach bankroll management with the rigor of portfolio allocation, recognizing the extreme volatility inherent in combining cryptocurrency exposure with gambling outcomes. The ecosystem continues evolving as platforms experiment with tournament structures that blend gaming mechanics with DeFi principles.

Bitcoin Price Prediction: Institutional Accumulation Amid Market Correction

Bitcoin's price trajectory faces bearish pressure following a recent market downturn, yet institutional accumulation persists unabated. Strategy, led by Michael Saylor, added 397 BTC ($45.6M) to its treasury at an average price of $114,771 per coin, bolstering its holdings to 641,205 BTC ($47.49B) acquired at $74,057 per bitcoin. The firm reports a 26.1% year-to-date yield on its BTC holdings as of November 2025.

Despite this institutional confidence, BTC has shed 6% in the past week, sliding from $113,890 to $106,270 amid sustained selling pressure. The October 10 crash continues to weigh on market sentiment, though sophisticated investors are increasingly diverting attention to emerging alternatives like Bitcoin Hyper. The SVM-based platform has secured $25.7M in early funding, positioning itself as a potential disruptor in the digital asset space.

Standard Chartered CEO Declares Cash Obsolete at Hong Kong FinTech Week

Bill Winters, CEO of Standard Chartered, delivered a bold proclamation during Hong Kong FinTech Week 2025: 'Money will be entirely digital.' His remarks underscore a seismic shift toward blockchain-based financial systems, with Winters predicting all transactions will eventually settle on-chain. The British banking giant, a dominant force across Asia, Africa, and the Middle East, now views this transition as inevitable.

Winters framed the move as more than technological adoption—it's a fundamental restructuring of global value exchange mechanisms. His comments align with Standard Chartered's bullish BTC outlook, having previously forecast a $135,000 price target for December. The speech emphasized aggressive experimentation to navigate this monetary transformation, positioning blockchain infrastructure as the backbone of future finance.

Bitcoin Nears $107K as Retail Inflows Collapse 80% Amid ETF Shift

Bitcoin trades above $106,000 as institutional demand and long-term holders reshape market dynamics. Retail participation has plummeted, with Binance inflows dropping from 552 BTC to just 92 BTC. Analysts present two contrasting scenarios: a short-term dip followed by a rally to $280,000, or a more conservative peak at $180,000.

The decline in retail activity, particularly among small holders known as 'shrimps,' signals a shifting balance in Bitcoin's investor base. Institutional interest remains steady through ETFs and corporate reserves, creating a cautious yet bullish undertone in the market.

Fed Shadows Dim the Trade Truce Glow

Markets shrugged off a long-awaited breakthrough in the US-China trade dispute, with risk assets showing little enthusiasm. Bitcoin dropped 1.7% over the week as equities wavered under renewed Federal Reserve uncertainty. The anticipated relief rally fizzled, revealing investor preoccupation with monetary policy over geopolitical developments.

Bitcoin Faces Selling Pressure as Long-Term Holders Liquidate Holdings

Bitcoin's market structure shows signs of strain as long-term holders accelerate sell-side activity. Onchain data reveals nearly 400,000 BTC liquidated over the past month, with the Long-Term Holder Net Position Change metric flashing persistent distribution signals.

Analyst Burak Kesmeci notes the 30-day trend has turned decisively negative, suggesting whales may be entering a profit-taking phase. Historical patterns indicate such sell-offs often precede local bottoms when the metric eventually stabilizes.

The sustained selling pressure contrasts with typical accumulation behavior, raising questions about near-term price support levels. Market participants are watching whether this represents strategic repositioning or broader loss of conviction among crypto's most steadfast investors.

Bitcoin's On-Chain Activity Cools as Price Holds Steady

Bitcoin's blockchain activity has entered a phase of unexpected tranquility in 2025. Following the speculative frenzy of 2024, the network now operates with mechanical precision. Average block sizes have shrunk, daily fees have plummeted 56% since January, and the fee-to-reward ratio has retreated to pre-Ordinals boom levels.

Despite this cooling on-chain activity, BTC's price exhibits remarkable resilience, hovering stubbornly above $110,000. The divergence paints a curious picture: a network running at reduced capacity while its market valuation maintains bullish positioning.

Miners face a shifting revenue landscape as fee income dwindles. The fee-to-reward ratio—a critical metric for network security—has slipped from 1.35% in Q1 to 0.78% in recent months. This compression suggests users are contributing less to Bitcoin's security budget, placing greater burden on block subsidies.

France Targets Bitcoin and Crypto with New 'Unproductive Wealth' Tax

France's National Assembly narrowly passed an amendment to impose a 1% annual tax on cryptocurrency holdings exceeding €2 million, classifying digital assets as 'unproductive wealth.' The proposal, led by centrist MP Jean-Paul Matteï, gained unexpected bipartisan support and now moves to the Senate for 2026 budget approval.

The tax targets unrealized gains—a first for crypto in major economies—applying even when assets remain unsold. A €3 million Bitcoin portfolio would trigger a €10,000 yearly levy. Critics argue this penalizes long-term holders, while proponents claim it aligns crypto with traditional wealth taxes.

Market observers note potential capital flight risks should the measure pass. Similar debates are emerging across Europe as regulators grapple with balancing innovation and taxation.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents both opportunities and risks for investors. The current correction below key moving averages suggests caution in the short term, but underlying institutional accumulation and growing adoption provide long-term bullish catalysts.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $104,219.97 | Below 20-day MA, testing support |

| 20-day Moving Average | $109,526.99 | Resistance level |

| MACD | -1,261.04 | Bearish momentum |

| Bollinger Band Support | $104,456.99 | Critical level to watch |

| Potential Downside | $92,000 | Analyst warning level |

According to BTCC financial analyst Emma, 'For long-term investors, current levels may represent accumulation opportunities, but traders should wait for confirmation of support holding before entering new positions. The fundamental case for Bitcoin remains strong despite short-term volatility.'